Special Offers

Special Offers

AAVAS FINANCIERS LIMITED was incorporated as a private limited company in Jaipur, Rajasthan, under the Companies Act, 1956 on February 23, 2011. The company formally started its operations in March 2012.

Company got registered with National Housing Bank as a Housing Finance Company (HFC) and awarded the license from National Housing Bank (NHB) in August 2011.

In 2013, the company was converted from Private Limited to Public Limited Company.

In March 2017, the name of the Company was changed to “AAVAS FINANCIERS LIMITED" vide a fresh Certificate of Incorporation (COI) dated 29th March 2017.

In October 2018, the Company got listed on BSE and NSE.

AAVAS is engaged in the business of providing housing loans, primarily, in the un-served and un-reached markets which include the States of Rajasthan, Maharashtra, Gujarat, Madhya Pradesh, Haryana, Uttar Pradesh, Chhattisgarh, Uttarakhand, Punjab, Himachal Pradesh, Delhi, Odisha, Karnataka and Tamil Nadu. Currently, we are operating in 14 states with a total of 397 branches.

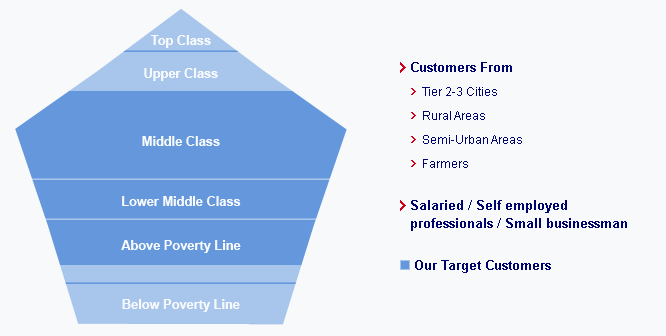

AAVAS is primarily engaged in the business of providing housing loan to customers belonging to low and middle income segment in semi-urban and rural areas. These are credit worthy customers who may or may not have the income proof documents like IT return, salary slip and hence are financially excluded by other large housing finance companies and banks. AAVAS uses unique appraisal methodology to assess these customers individually. The financing solution need to be appropriated and suitable to them.

AAVAS believes that every customer is unique and so far as their financial needs & feel it is absolutely necessary not to treat them as homogenous group of borrowers but appreciate the individual need of every customer, and offer housing Finance solutions that are appropriate and suitable to them.

AAVAS is engaged in the business of providing housing loan to customers belonging to low and middle income segment in semi-urban and rural areas. These are the people who are either self-employed, running small businesses like providing transportation facilities in auto rickshaw or other vehicles, running grocery shops, tiffin centers, beauty parlous and other businesses or these customers are carrying out business of agri or animal husbandry products in rural areas or salaried class people who are carrying out small jobs in private or public sector.

All above people have one prime aspiration of owning their own home and thereby creating an adorable environment for their family members to live in.

These are credit worthy customers that lack financial inclusion because of underdeveloped banking facilities or due to lack of documents like IT returns, salary slips, etc. and hence are excluded by other mortgage companies.

AAVAS uses a unique appraisal methodology to assess these customers individually and delivers tailor-made financing solutions.

AAVAS caters the needs of various small families in rural areas, towns, and a city's peripheral area and other semi-urban areas to meet their life time dream to own their own house.

Presently AAVAS is operating in 14 states namely Rajasthan, Gujarat, Maharashtra, Madhya Pradesh, Delhi, Uttar Pradesh, Chhattisgarh, Haryana, Uttarakhand, Himachal Pradesh, Punjab,Tamil Nadu, Odisha and Karnataka.

The Company has a team of dedicated staff members including highly qualified professionals like Chartered Accountants, Company Secretaries, MBAs etc. who have been contributing to the progress and growth of the Company. The manpower requirement of the offices of the Company is assessed and recruitment is conducted accordingly. Personal skills of employees are fine-tuned and knowledge is enhanced by providing them internal and external training, keeping in view the market requirement from time to time.

AAVAS is engaged in 3 types of products mentioned below under its housing finance business:-

The product is designed to purchase individual dwelling units, flats in low cost buildings, detached and semi-detached units, cluster units, and residential units. This is also applicable for properties under construction or ready built property.

The product is designed to offer loans for construction on a plot of land, which has been already acquired.

This product is designed to offer loans to individuals for extension of an existing home unit, which can include construction of additional rooms, floors etc.

AAVAS also launched "Special Urban Low Income Housing Product" and "Specific Women Ownership Product" in line with NHB's refinance scheme for the Special Urban Housing Refinance Scheme for Low Income Households and Refinance Scheme for Women.